Best Apy Savings Account

In Emergency Fund 101, we went over some key considerations you should ponder before building your emergency fund.

Your savings account rate is adjusted according to the daily values, but we gage our rates so that they are highly competitive and among the top savings accounts’ in the United States. Earn interest on as much money as you want. The Money Market account, on the other hand, offers a 0.45% APY (as of February 2021) and has no fees or balance requirements, presenting a simpler alternative to the Savings Builder account. Both accounts are FDIC-insured, have interest compounded on a daily basis, and offer easy check deposits through CIT Bank’s mobile app. My favorite bank transfer hub is the American Express® High Yield Savings Account:. Earn 0.50% APY on your deposits. Your High Yield Savings account earns interest daily and is posted to your account monthly. Links easily with your current bank accounts. No need to switch banks. As of, the Annual Percentage Yield (APY) of the Premium Savings Account offered by E.TRADE Bank is 0.05% for balances of $500,000 or more, 0.05% for balances of $100,000–$499,999, 0.05% for balances of $50,000–$99,999, 0.05% for balances of $5,000–$49,999, and 0.05% for balances of less than $5,000. Rates are subject to change daily.

Here’s a list of some excellent options of where to park your emergency fund. Some of these have quite low caps for their savings rate, but keep in mind that you can spread it out between two or three accounts if need be.

People tend to complain about the hoops they have you jump through, but think of it based on the income you’ll be earning from the additional interest income in relation to your approximate hourly work rate. If you are only going to deposit $1,000 and yet you make $50 an hour, then it may be right not to quibble about tiny losses, since time you divert to maintaining the accounts presents an opportunity cost, or less time you could be spending on other things that potentially make you more money. But I advise against being dismissive of these offerings simply due to the presence of monthly requirements.

Importance of Interest Rate

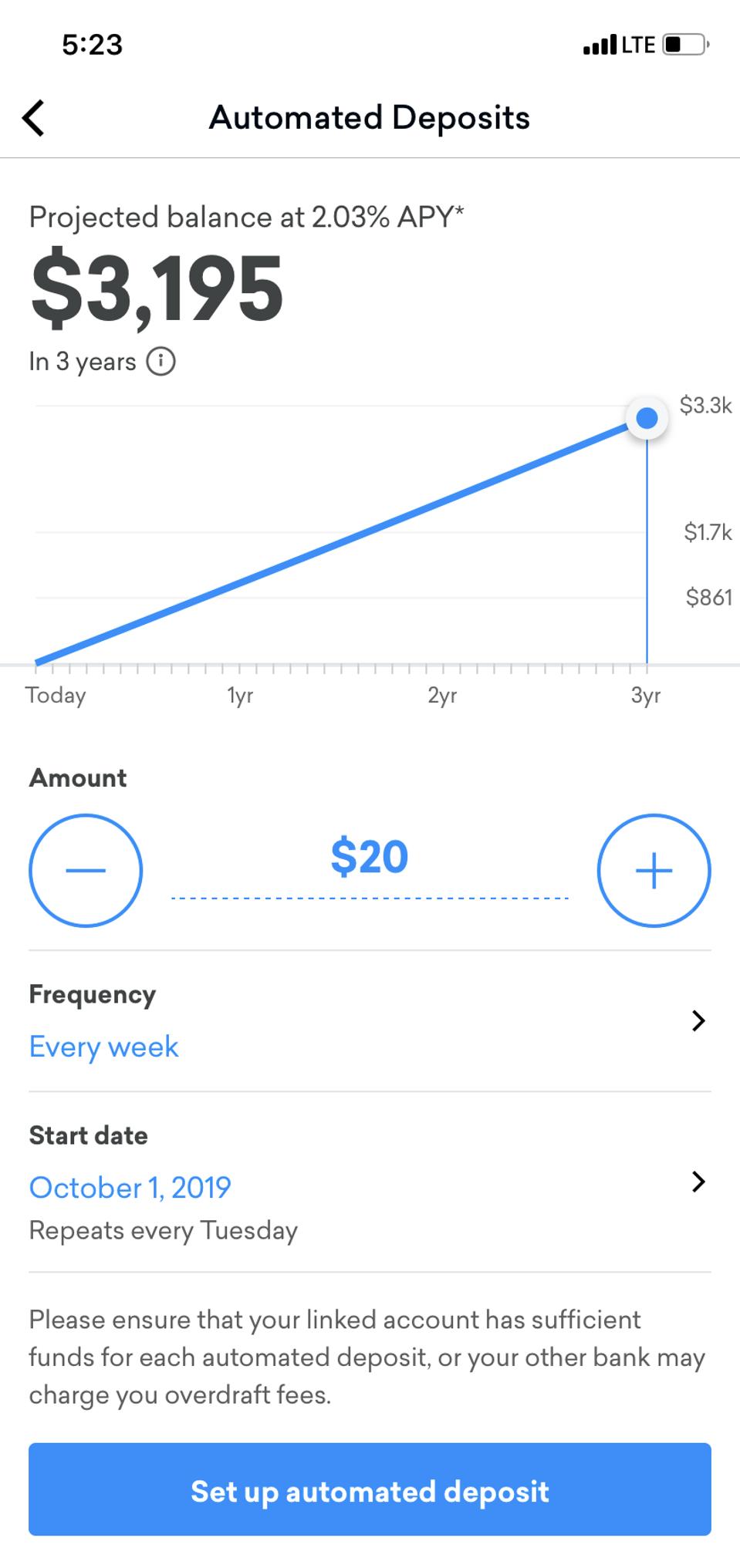

Don’t underestimate the difference that a couple percent could make in the growth of your savings. To use the rule of 72 for a rough estimate how long it will take your money to double, just divide 72 by the compound annual interest rate (without converting it to a decimal).

Examples

- 72 divided by 3 (for a 3% interest rate) gives us 24, meaning it will take 24 years for money you don’t touch in an account to double due to compounding.

- For a 5% interest rate, 72/5 = 14.4, meaning it would take 14.4 years for your money to double.

- For a 6% interest rate, 72/6 = 12; your money would double in 12 years.

- For your money to double in one decade, you’d need a 7.2% interest rate, since 72/7.2 = 10.

The rule is more accurate for lower rates.

Of course, that’s before taxes and inflation are factored in.

Nationwide Accounts Yielding 5% APY and Up

Mango Savings Prepaid Reloadable Card – 6% APY on up to $5,000

Requirements

- Net direct deposit of $800 and a balance of $1 at the end of the month

Additional Information

- 5.85% APR

- $3 monthly fee

- $2 ATM withdrawal fee + ATM owner fees

- $1 ATM balance inquiry fee

- $20 bonus upon enrolling in direct deposit

- 2% APY without direct deposit

- 0.10% APY on balances exceeding $5,000

- Maximum of six savings withdrawals per month (as law mandates for all savings accounts)

- Options for reloading: 1) Direct deposit. 2) Partnered with Green Dot so you can make a cash deposit at a handful of stores, but a service fee of up to $4.95 will apply. 3) At any location that accepts Visa ReadyLink. 4) Paypal. 5) Bank transfer.

- Interest is compounded monthly and credited to your account on the last day of each month

Digital Federal Credit Union Statement Savings Account – 5.12% APR on $750

Requirements

- $5 to open

Additional Information

- Dividends are compounded daily and provided monthly

- No fees

- 5% APR (simple rate that doesn’t account for compounding)

- 0.05% APY on balances exceeding $750

Blue Federal Credit Union Accelerated Savings – 4.99% APY on up to $1,000

Requirements

- $25 initial deposit

- $5 monthly deposit, as well as a $5 monthly balance (requires $25 balance for advertised APY). I asked for more details and they responded saying it can come from either your payroll or another bank account so long as the online transfer is set up automatically (it must show up as an electronic transaction).

- 4.88% APR (different from APY, which includes the additional earnings from compounding)

- Dividends (not interest since this is a credit union, but they’re functionally the same) are compounded daily, paid monthly

Additional Information

- 0.10% APY on balances exceeding $1,000

Netspend Prepaid Savings Account Cards – 5% APY on up to $1,000

* Not open to residents of Vermont

Basic Details of Netspend Cards

- Savings account is an optional addition to main card

- No monthly fee under the Pay-As-You-Go Plan (some Netspend cards (Control: $7.95 per month and Paypal Prepaid [$4.95 per month]) require a nonwaivable monthly fee, which is why I’m excluding them)

- No fee charged for direct deposit

- You’ll be paid up to two days faster with direct deposit of paychecks and government payments

- $1.00 for transactions requiring a signature, $2 for transactions requiring a PIN (both under the Pay-As-You-Go Plan)

- $2.50 ATM withdrawal fee plus ATM owner fees

- 0.5% APY on balances exceeding $1,000

- One way money can be loaded is at a NetSpend Reload Center (there are 130,000+)—fees vary by location

- $5.95 inactivity fee applies if there are “no purchases; no cash withdrawals; no load transactions; or no balance inquiry fee for 90 days,” per the cardholder agreements. One possible way to evade the fee is to automate a $1 transfer to the card from your regular bank account each month.

- No fee for balance inquiry over the phone, or via text or email, but 50 cents for any other method

- Cardholder agreements state, “For Cards purchased in a retail location, fee will be determined by operator of retail location or website, not to exceed $9.95.”

- There’s a refer-a-friend program with unlimited referrals. When your referral funds their new card with at least $40, you’ll each get a $20 credit in the case of Netspend and Western Union, but just $10.00 in the case of ACE Elite. Not valid if the person referred had activity on a Netspend card during the 180-day time frame preceding the time of referral.

Unofficial reports from cardholders state that five Netspend accounts are permitted, with a total of three permitted by each unique bank.

Brinks Prepaid MasterCard Savings Account

- Issued by BofI Federal Bank

ACE Elite Prepaid MasterCard Savings Account

- Issued by MetaBank

Netspend Prepaid MasterCard Savings Account

- Issued by The Bancorp Bank, BofI Federal Bank, MetaBank, and Republic Bank & Trust Company.

Western Union Netspend Prepaid MasterCard Savings Account

- Issued by MetaBank

Best Apy Savings Account 2019

Northpointe Bank Ultimate Checking Account – 5% APY on up to $5,000

Requirements

- $100 initial deposit to open (but no minimum balance requirement)

- 15 in-person or online debit card purchases totaling $500 per month

- Set up direct deposit, automatic withdrawal, or bill pay totaling $100 per month

- Enroll in eStatements

Additional Information

- Interest compounds and is paid out monthly

- 4.89% APR (note this is different from APY, which considers compounding)

- No monthly fee, but a dormant fee of $5 applies after 12 months of inactivity on checking accounts and 24 months on savings accounts

- Offers refund of ATM fees up to $10 per month

- Balances exceeding $5,000 receive 0.10% APR or 2.55%–5% APY

- $10 fee if account is closed within 120 days of opening

Insight Savings Visa Prepaid Reloadable Card – 5% APY on up to $5,000

Requirements

- Balance of $10

Additional Information

- No monthly fee under Pay-As-You-Go Plan

- Interest is compounded daily and paid quarterly

- 4.88% APR

- If you do a direct deposit, it’s posted immediately; no hold time

- Checks available (but you must authorize them individually before use)

- Partnered with Green Dot so you can make a cash deposit at a handful of stores, but a service fee of up to $4.95 will apply.

- Made available through the Republic Bank of Chicago or Axiom Bank

- Inactivity fee of $3.95 after 90 days without account activity, including purchases, cash withdrawals, and load transactions. One possible way to evade the fee is to automate a $1 transfer to the card from your regular bank account each month.

return to footnote reference1Savings-account interest is compounded and credited monthly, based on the daily collected balance. Interest rates are variable and determined daily at Chase's discretion and are subject to change without notice. Balance tiers are applicable as of the effective date of these rates and may change at Chase's discretion. Account fees could reduce earnings. CD interest is fixed for the duration of the term and is compounded daily.

return to footnote reference2For Chase Premier SavingsSM: Earn Premier relationship rates when you link the account to a Chase Premier Plus CheckingSM or Chase SapphireSM Checking account, and make at least five customer-initiated transactions in a monthly statement period using your linked checking account. See interest rates.

Best Apy Savings Account Online

Savings Text Message Program: Message and data rates may apply. For Help call 1-800-935-9935. Reply STOP to 33172 to no longer receive Chase Savings text messages until you provide your consent again. Mobile carriers not liable for delayed or undelivered messages.

Banks With Best Apy Savings Account

IMPORTANT INFORMATION

Best Online Banks For Savings

The content of this page is informational only. Accounts are subject to approval. The terms of the accounts, including any fees or features, may change. See the Deposit Account Agreement and Additional Banking Services and Fees for the terms and conditions associated with these products.