Chase Direct Deposit

- Direct deposit at Chase is the safest, fastest and most convenient way to seamlessly deposit your paycheck, or any other recurring payment, into any of your Chase bank accounts. With direct deposit, your checks can’t be lost or stolen. Direct deposit means no more pointless trips to the bank, no wasted time, no long lines, and the freeing up.

- The following code as a direct deposit: Chase: 1 (waived the monthly fee) Frontier Bank. No data points; Frontwave Credit Union. The following coded as a direct deposit: Fidelity: 1 (via e-mail on 11/17) Fulton Bank. The following have not worked for direct deposit: Capital One 360: 1, Chase: 1, Citi: 1; Discover: 1; Huntington: 1; Wells Fargo.

Direct deposit at Chase is the safest, fastest and most convenient way to seamlessly deposit your paycheck, or any other recurring payment, into any of your Chase bank accounts. With direct deposit, your checks can’t be lost or stolen. Direct deposit means no more pointless trips to the bank, no wasted time, no long lines, and the freeing up of your valuable time for family, friends and fun.

Another great feature of direct deposit for the employee is that you no longer have to wait for your check to clear. Your money is available to you immediately online, at any Chase branch, or through telephone banking. Direct deposit is great for employers, too, because it allows them to avoid the costs involved in printing, processing, and mailing paper checks to employees. It also avoids those particularly troublesome problems that can occur if an employee’s check is lost or stolen.

Subscribe to Chase here: can have your paycheck sent right to your checking or savings account automatically with Direct Deposit so. Set up a direct deposit alert, so you’ll know when you receive your stimulus payment. When you set up your alert, make sure you choose the checking or savings account you expect the payment to be deposited to. Learn how to use Chase QuickDeposit℠ so you can deposit checks with your mobile phone or tablet from the Chase Mobile app.

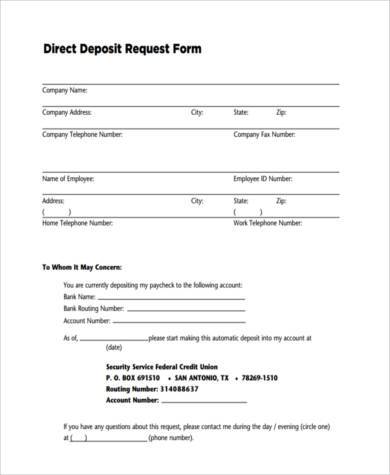

You can obtain a Chase Direct Deposit Form online, or at any Chase branch. Filling it out is fast and easy.

How to Fill Out a Chase Direct Deposit Form

The top of the a Chase Direct Deposit Form, or Direct Deposit Application as it is called, has spaces for you to print your name, address, city state and zip code. The next part of the form asks if you want your funds deposited into a checking account or a savings account. It then asks for your Account Number and your Bank’s Routing Number.

Chase Bank Direct Deposit Offer

Discerning just what these numbers are and where to find them is often the source of considerable confusion to most people, but the Chase Direct Deposit Form includes a helpful and important feature not usually seen in documents of this type. There is an illustration of a typical bank check, with an illustration of the combined bank Routing Number, individual Account Number, and check number that always appears on the bottom left corner of all U.S. bank checks.

This illustration makes it easy to comply with the Chase Direct Deposit Form’s request for your Account Number and for your bank’s Routing Number.

Chase Direct Deposit Information

The next, part of the form asks for your permission for Chase to automatically deposit your payroll check into the bank account that you listed. You are asked to sign and date the form. Finally, you are asked to attach a voided check to the form and to take the completed application to your employer’s payroll department. At this point, they will gladly take care of it from here.

Chase also offers an Automatic Payment Change Form. This form is very useful if you change banks, or simply want your deposit made to another bank. It is a very simple form, and one must be filled out for every payment stream that you would like to change.